Fascinated In Choosing A Dependable Insurance Policy Firm? Discover Key Factors To Consider That Make Certain Both Peace Of Mind And Extensive Insurance Coverage In This Comprehensive Overview

Post By-Filtenborg Reid

When it pertains to selecting an insurance policy firm, you must be vigilant in your search for integrity and trustworthiness. The procedure includes more than just a general eye a firm's site or a brief phone call. It requires a meticulous examination of several vital aspects that can make all the difference in securing assurance and detailed coverage. By putting in the time to recognize these important elements, you can browse the complicated landscape of insurance companies with confidence and guarantee that you are making a sound choice for your future monetary safety.

Recognizing Your Insurance Policy Needs

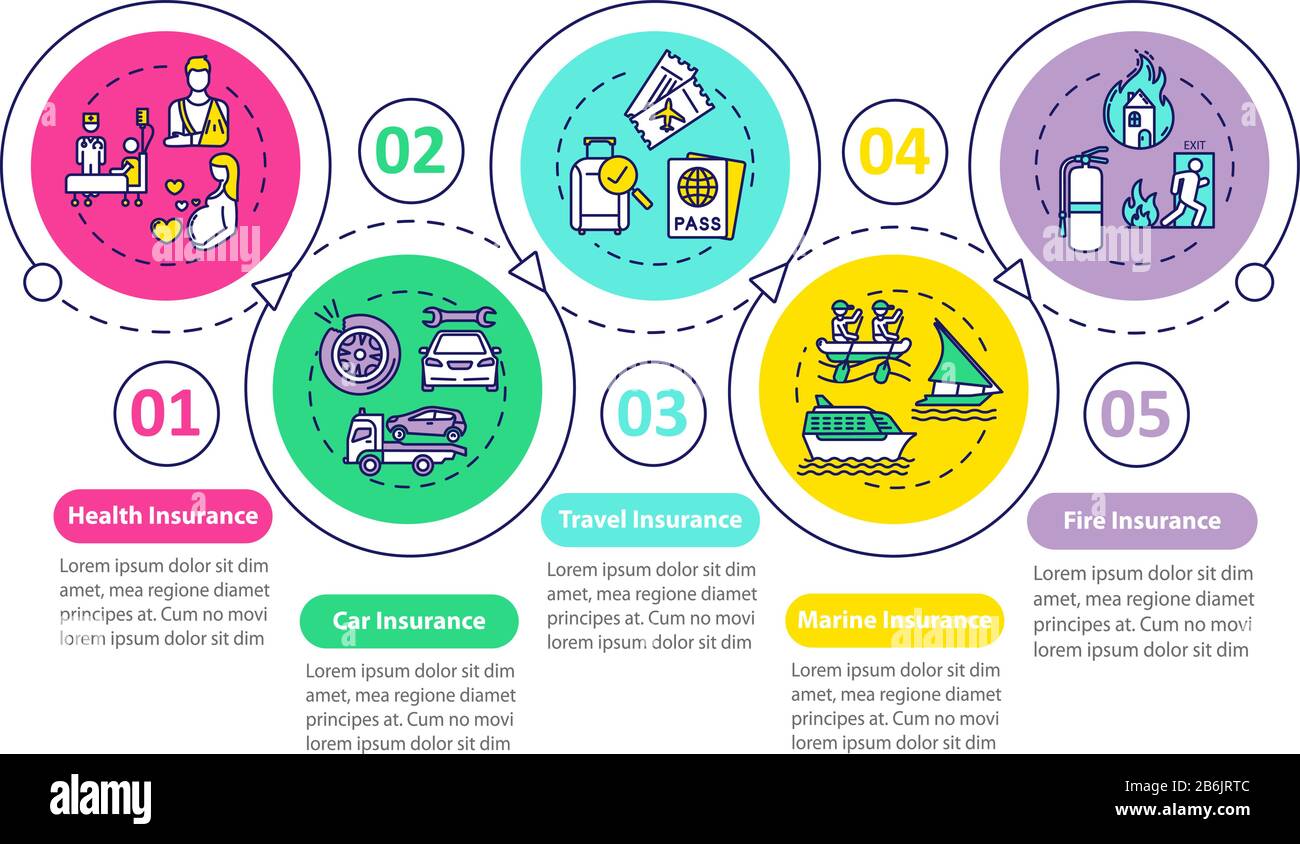

When it involves locating a credible insurance policy agency, the very first step is understanding your insurance needs. Take a moment to assess what kind of coverage you call for. Take into consideration factors such as your wellness, residential or commercial property, automobiles, and any other properties that might require defense. Are click here trying to find basic insurance coverage or more detailed alternatives? Comprehending your needs will assist you limit the sort of insurance policies you should be seeking.

Evaluate your budget plan and identify just how much you can comfortably manage to spend on insurance policy premiums. Bear in mind that while it's important to find cost effective insurance coverage, you also intend to make certain that you're appropriately protected in case of an emergency situation.

Last but not least, take into consideration any certain demands or choices you might have. Do you choose collaborating with a regional company for personalized solution, or are you comfortable handling your insurance coverage requires online? By clarifying your insurance coverage needs, you'll be much better equipped to discover an agency that can satisfy your specific needs.

Researching Potential Agencies

Comprehending your insurance coverage requires is important for discovering the best protection, but once you have a clear image of what you call for, the following step is researching prospective firms. Begin by looking for suggestions from friends, household, or professional networks. On the internet testimonials can additionally give important insights into the experiences of various other consumers.

Search for firms that specialize in the kind of insurance you need, whether it's automobile, home, health, or service insurance. Confirm the agency's trustworthiness by examining if they're qualified and have an excellent standing with regulative bodies. A trusted company ought to be clear concerning their services, pricing, and any type of possible disputes of rate of interest.

Take https://click4r.com/posts/g/18418348/why-engaging-an-insurance-coverage-agent-could-be-necessary-for-your-o to go to the agency in person ideally, to get a feel for their professionalism and reliability and customer service. In addition, ask about the variety of insurance products they use and request for quotes to compare with various other agencies. Looking into possible agencies thoroughly will aid you make an informed choice when choosing the appropriate insurance partner for your needs.

Reviewing Agency Credentials

To ensure you're handling a credible insurance policy agency, evaluating their credentials is extremely important. Beginning by examining if the firm is licensed in your state. A legitimate certificate suggests that the firm meets the state's needs and is licensed to offer insurance. Look for accreditations such as being a Chartered Insurance Expert (CIP) or holding memberships in reliable market associations like the Independent Insurance Representatives & Brokers of America (IIABA). These credentials demonstrate a dedication to professionalism and reliability and continuous education and learning.

In addition, assess the agency's online reputation by checking on the internet testimonials, requesting for references from good friends or household, and asking about their standing with the Bbb (BBB).

Examine the experience of the company and its representatives in dealing with insurance issues similar to your demands. A well-established firm with experienced specialists is more likely to give trusted recommendations and service. Do not be reluctant to inquire about the series of insurance products they use and inquire about any specific proficiency they might have in specific locations.

Final thought

Finally, by putting in the time to comprehend your insurance requires, researching potential firms, and examining their qualifications, you can find a trustworthy insurance company that satisfies your needs. Remember to look for suggestions, check online evaluations, and validate licensing to guarantee you are partnering with a reliable company. With comprehensive research study and careful consideration, you can with confidence select an agency that supplies trustworthy coverage and comfort.